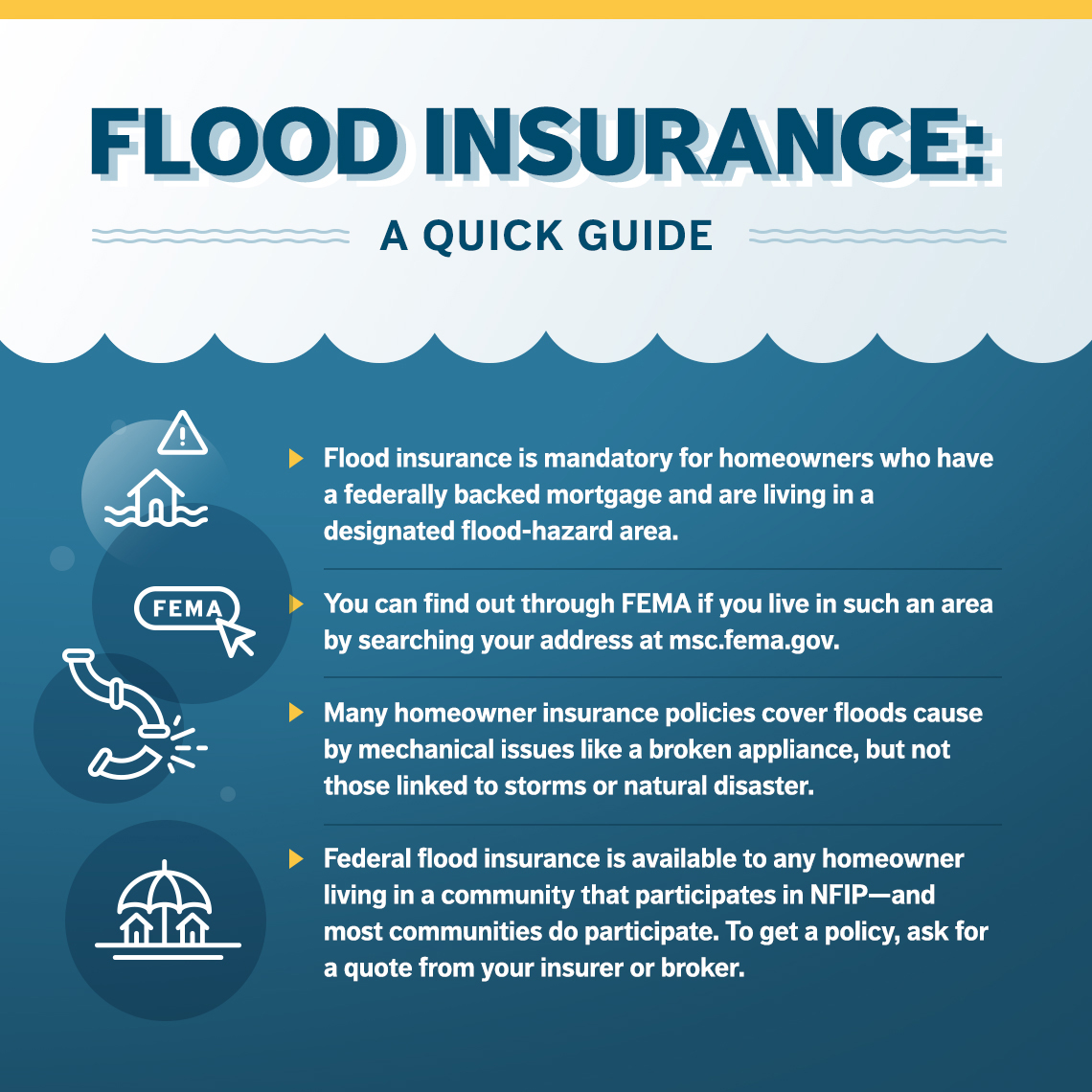

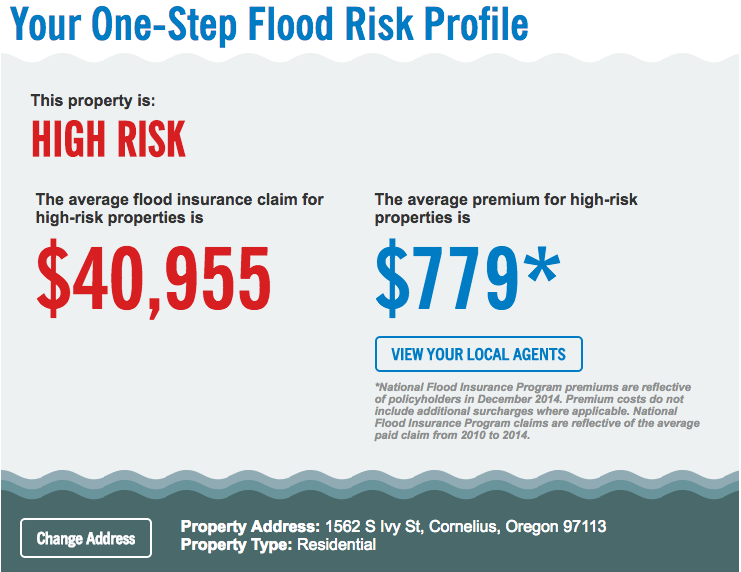

The change is aimed at rectifying disparities in flood insurance costs, FEMA says, that were previously criticism from inland states that previous rates amounted to national subsidies for coastal areas more prone to flooding. If you don’t have flood insurance, your likely out-of-pocket cost for 3 inches of water (based on a 1,000 square foot, single-story home) is estimated at about 12,000. The minimum cost you can expect to pay is 1,000, while the maximum cost is 8,000. FEMA says Risk Rating 2.0 considers an individual property’s risk of flooding, instead of primarily relying on flood maps, to determine the cost to insure it against flood damage. The average flood damage incident costs homeowners between 2,000 and 5,000. The newly released data on the program estimates the total expected increase, which will take many properties several years to reach.ĭetails have been sparse about how FEMA calculates premium prices under the new system despite repeated questioning and criticism from Louisiana’s Congressional delegation. A critical federal analysis of extreme rainfall is vastly underestimating the chances of flood events, with grave implications for everything from new roads and bridges to the rising cost. Most homeowners insurance does not cover flood damage. Limited Displacement Costs (expenses incurred while unable to live in structure). Floods can happen anywhere just one inch of floodwater can cause up to 25,000 in damage.

FLOOD INSURANCE COST ESTIMATE ZIP

Before the plan took effect in 2021, the agency released data showing 98% of policies for single-family homes in Lafayette ZIP Codes would either see their premiums drop or increase by less than $120 by the end of 2022. The National Flood Insurance Program (NFIP) is managed by the FEMA and is delivered to the public by a network of more than 50 insurance companies and the NFIP Direct. For example, 70503, which covers Lafayette between Johnston Street and the Vermilion River, is expected to see average rates jump 157% - more than $1,150 a year - under Risk Rating 2.0.Įarlier estimates were limited to just the first year of the Risk Rating 2.0 system’s implementation. Premiums will double in other parts of the parish, particularly in areas along major drainage channels and where widespread development is prevalent.

If your coverage is issued through the National Flood Insurance. National Flood Insurance Program premiums are expected to increase significantly in Lafayette under the new Risk Rating 2.0 system.Īround 15,000 single-family homes with flood insurance policies in Lafayette Parish will be impacted. You can use the cost of flooding calculator at to estimate your costs.

0 kommentar(er)

0 kommentar(er)